About Us

A Service That Pays You Back

Everyday Help Financial™ was built for people doing their best — but still feeling behind, disorganized, or unsure about money.

We’re not here to sell you an app or pitch you investments. We’re real people who help you take control of the everyday financial tasks that pile up and quietly cost you money.

Whether it’s:

Helping a single mom sort through overdue bills and set up affordable payment plans,

Saving a young couple $80/month by switching to a better car insurance plan,

Canceling a dozen forgotten subscriptions for a busy nurse,

Unlocking pharmacy discounts for a retiree on a fixed income, or

Negotiating down phone and internet bills for a self-employed contractor...

Our Coordinators step in where life gets messy.

We find savings. We keep you on track. And we make your financial life feel manageable again.

Most clients save more than they spend on our service. That's not a marketing line, it's our business model.

If we’re not saving you money, we’re not doing our job.

Talk to your Personal Financial Coordinator. No pressure. Just answers.

We’ll explain how the plan works, what kind of savings we typically find, and how we split any verified wins — so you always come out ahead.

We won't ask for complicated spreadsheets. We'll help you take real, simple steps that save money that you can put right back into your pocket

You won't talk to bots. You'll work with a Coordinator who knows your name, your goals, your challenges, and actually follows up!

This isn't a one-time audit. (Unless you want it to be.) We stick with you, month after month, to help you keep more of what's yours.

We focus on real savings and meaningful results, not generic advice. If we're not helping your bottom line, we're not doing our job.

Our Standards

Training & Trust: Why Our Financial Coordinators Are Different

This isn't casual coaching. It's professional Financial Coordination.

Everyday Help Financial's Financial Coordinators go through a multi-step training system designed to protect you and them — legally, emotionally, and financially. They're not strangers on the internet. They're certified, trained, and supported with real systems to get you real results.

Compliance & Legal-Risk Training

Our Coordinators are trained under federal laws like the Credit Repair Organizations Act (CROA) and other consumer protection regulations. They learn how to:

Handle legal disclaimers

Set professional boundaries

Protect personal data

Stay compliant — and keep you protected too

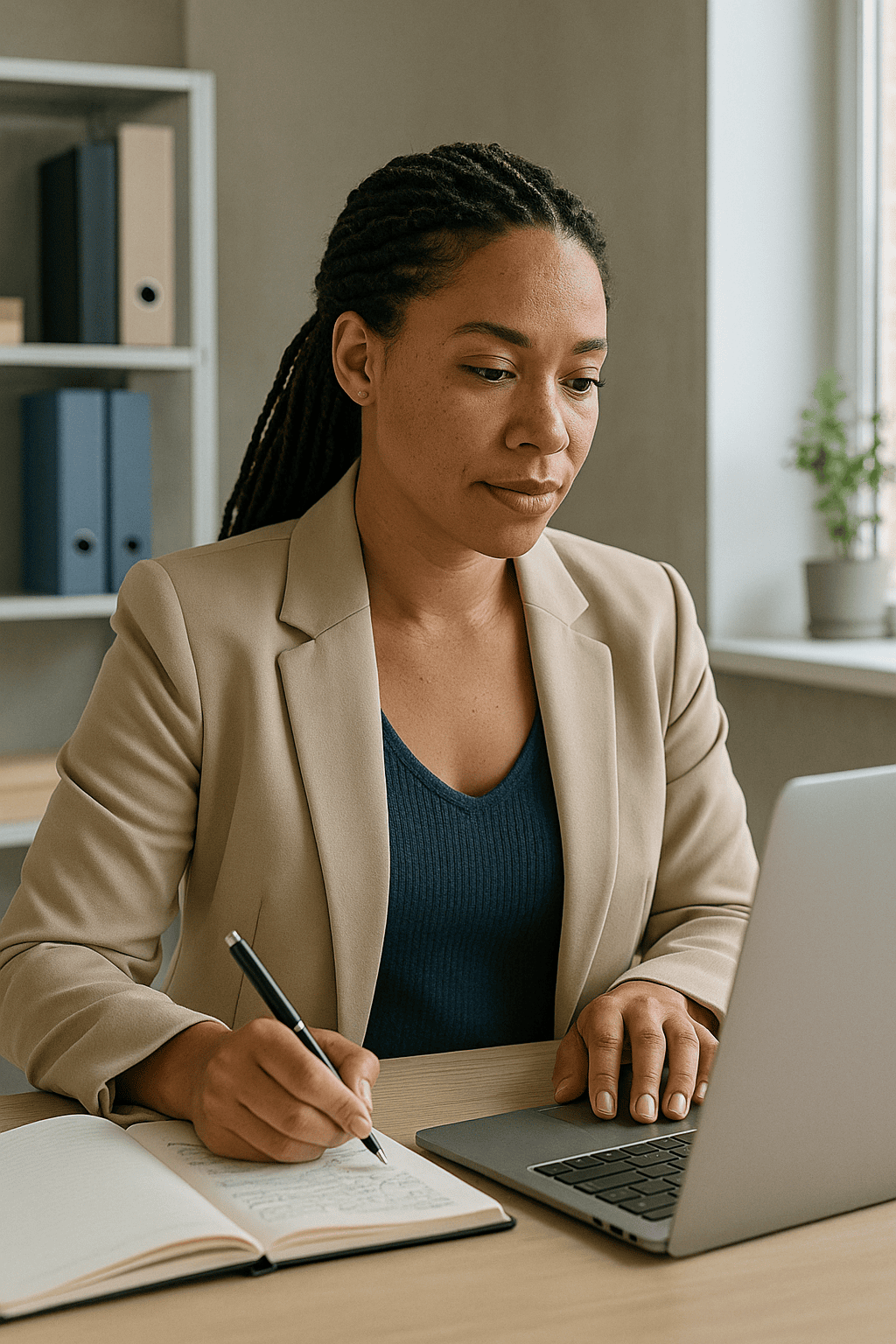

Hands-On Savings & Services Training

We train our Financial Coordinators with real-life scenarios so they can actually deliver wins. Training includes:

Canceling unwanted subscriptions

Negotiating bills (internet, phone, insurance)

Reviewing and explaining credit reports

Creating actionable savings plans

Spotting financial red flags early

This isn’t abstract advice. It’s financial help that actually helps.

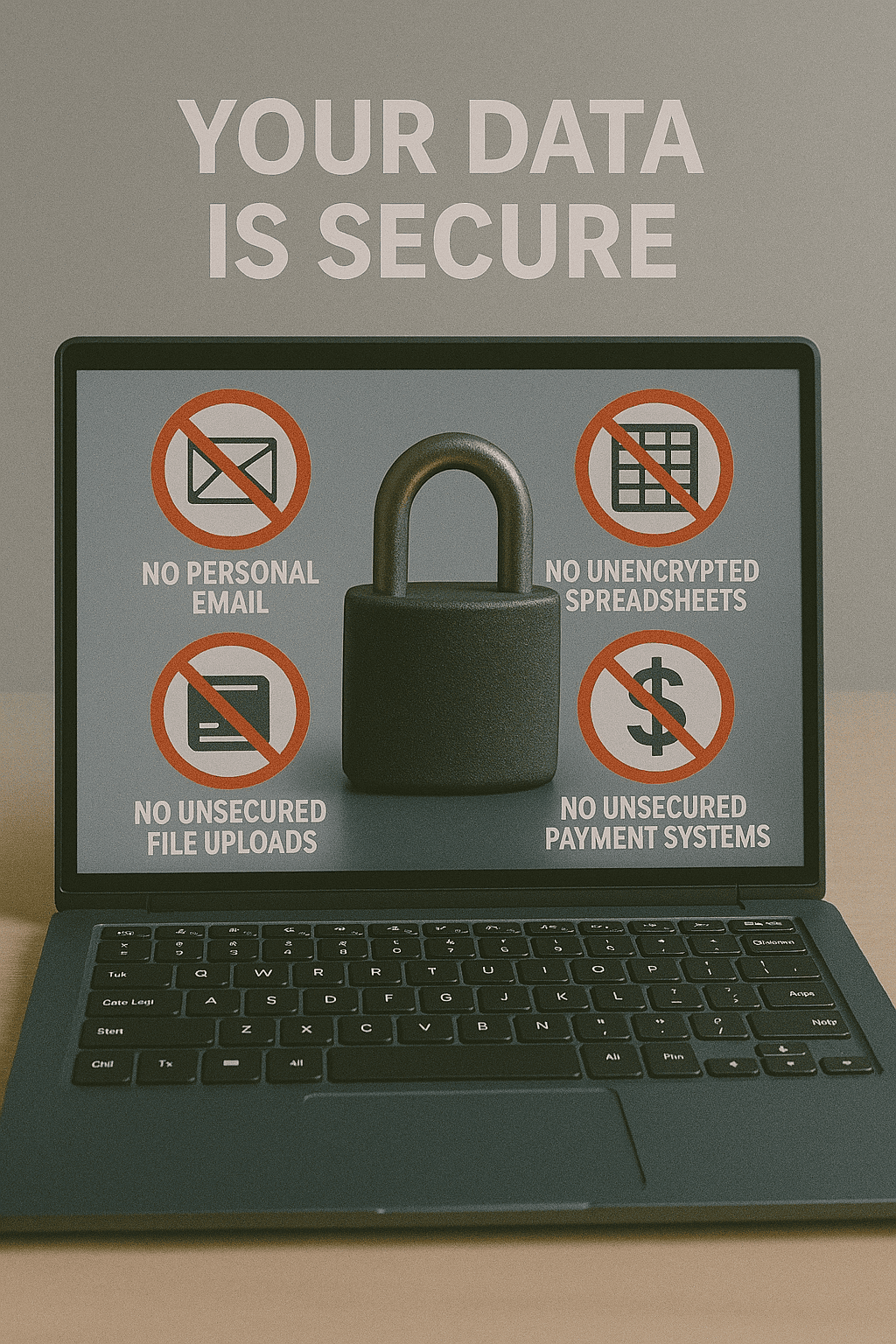

Data & Document Security

We don’t play around with your personal information.

No personal email. No unencrypted spreadsheets. No unsecured file uploads.

Our Coordinators are required to use:

Encrypted client portals

Secure CRM communication

Verified billing systems

Professional tools for document handling

Financial coordination is done safely — or not at all.

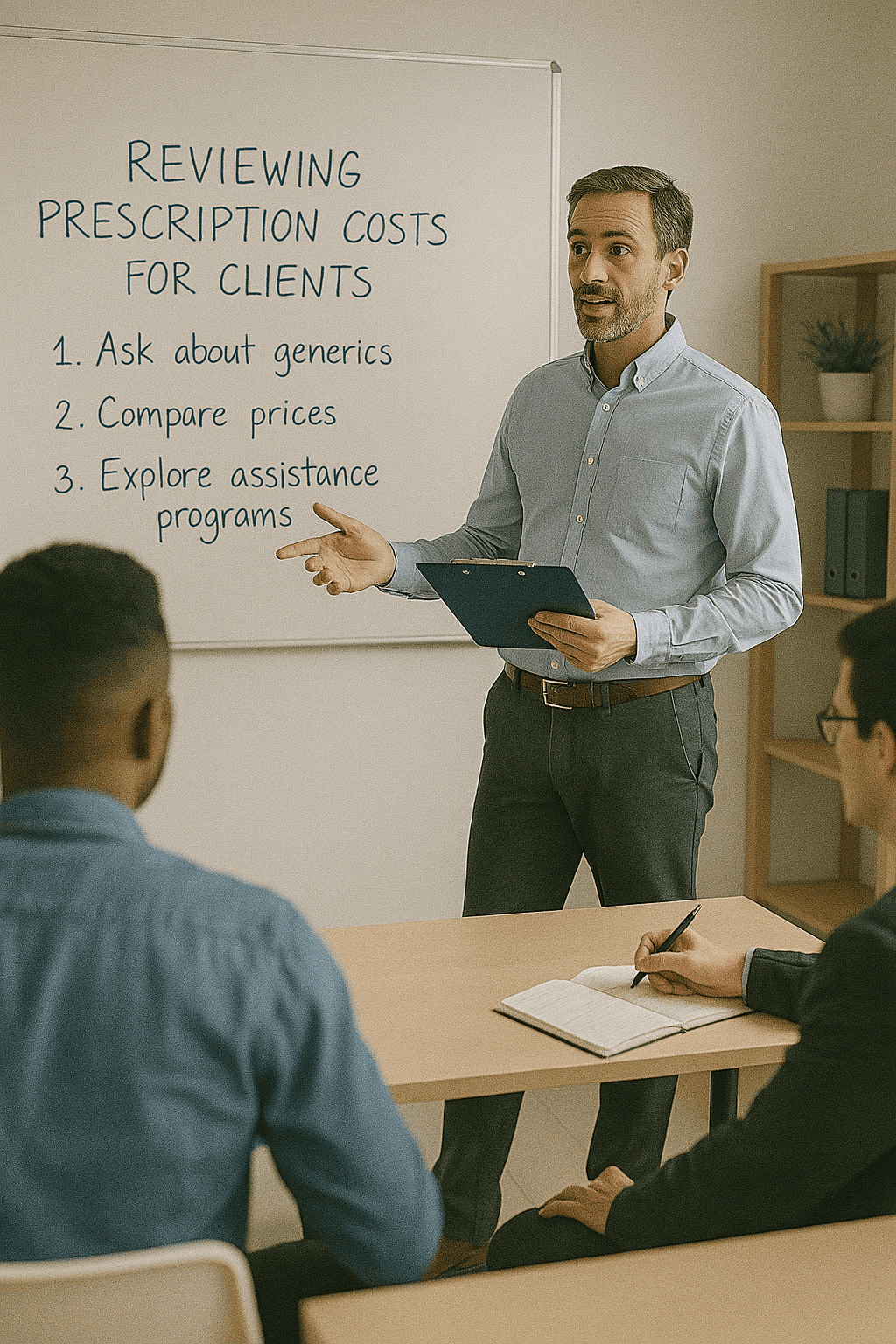

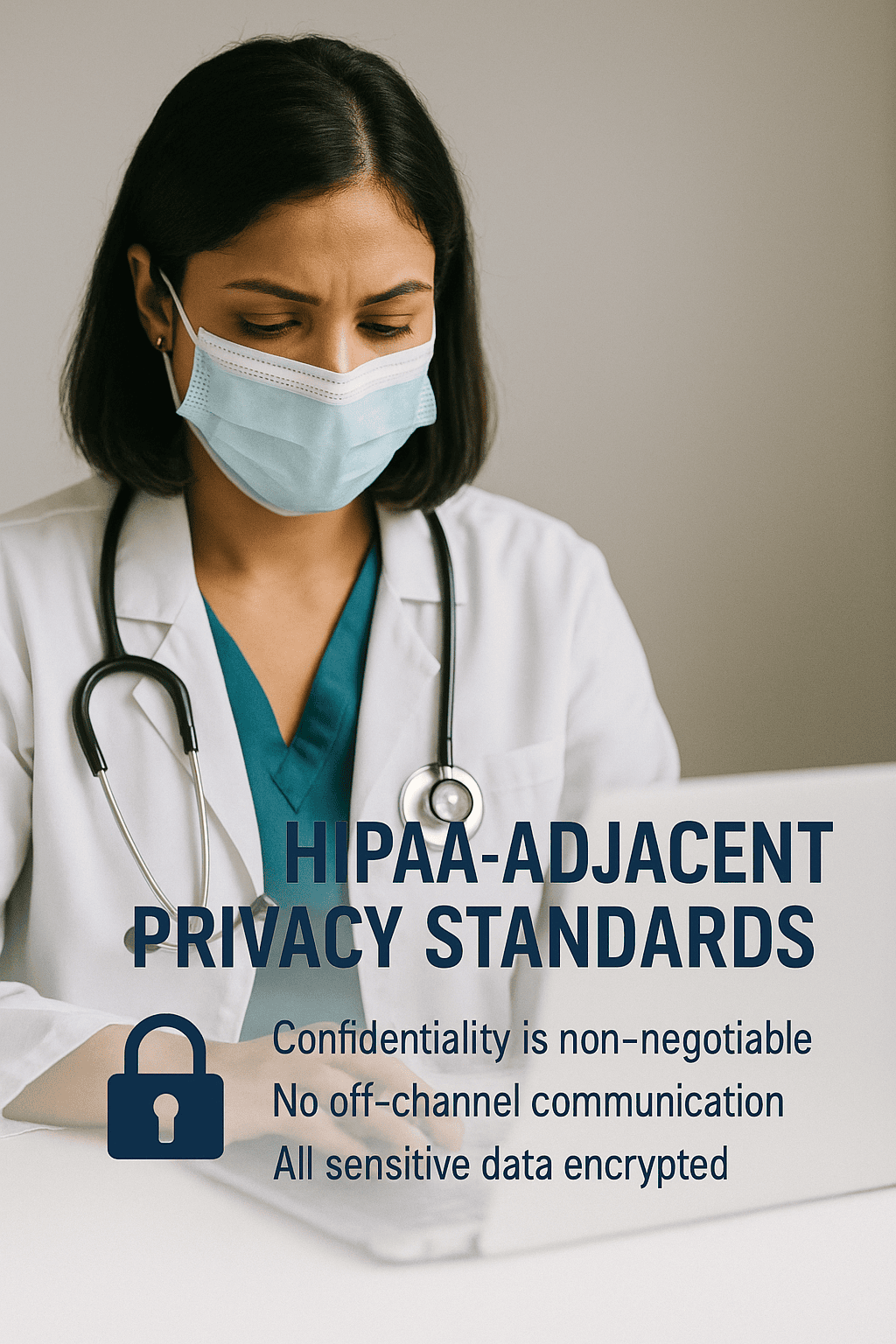

HIPAA Level Privacy Standards

We’re not a healthcare provider, but we protect your info like one.

We say HIPAA Level Privacy for a reason:

Our Coordinators often work with your health insurance, prescriptions, medical bills, and pharmacy discounts, so we train for that level of privacy.

Here’s what that means:

Confidentiality is non-negotiable

No oversharing or casual mentions of your situation

No off-channel communication (no texting or social media DMs)

All sensitive data stays in encrypted, HIPAA secure systems

Whether we’re reviewing your Medicare plan or helping you save on a prescription,

Your personal health and financial data is treated with medical-grade discretion.

We don't have to use these standards because we are not your medical provider, but we want to because it’s not just about money, it’s about your life.

What We're NOT, And Why It Matters

Our Coordinators are not:

❌ Lawyers

❌ CPAs

❌ Investment advisors

❌ Tax preparers

❌ Licensed sales agents

They do not:

Offer legal advice

Sell financial products

File taxes

Push risky investments

They do:

Understand the legal rules and regulations

Know how to stay compliant

Deliver support backed by structure

Help you move forward without overstepping

More Training Than Most "Money Coaches"

The truth? Most local or online financial coaches:

❌ Have never taken a compliance course

❌ Don’t know the legal risks of giving advice

❌ Use unencrypted email, public spreadsheets, and unsafe payment methods

❌ Rely on luck instead of structure

We’re not “most coaches.”

We’re a company built on training, systems, and accountability.

Trust Is Earned. We've Built It For You

Money is personal. That’s why we’ve built our entire company around earning your trust.

✅ All Coordinators pass our internal certification process

✅ We track performance and retrain when needed

✅ We give clients clear expectations and boundaries

✅ We back Coordinators with real systems and secure portals

This isn’t just a gig. It’s a professional service designed for everyday people.

Our Promise To You

We don’t just say “trust us.”

We train for trust.

We build for safety.

And we deliver results that make your financial life better.

At Everyday Help Financial, you’re not hiring a random coach.

You’re working with someone who’s trained, certified, and backed by real systems.