Debt Payoff Strategy

Finally see a clear path out of debt.

We turn "I don't know where to start" into a step-by-step payoff plan you can actually follow.

Why It Matters:

Most people “wing it” with debt:

They pay whatever bill is yelling loudest that month

They stick to minimums and feel like nothing ever changes

They’re scared to even add up how much they owe

That leads to years of stress, wasted money on interest, and a constant feeling of being behind.

A clear payoff strategy matters because it:

Shows you exactly where your money is going

Gives you a realistic timeline instead of vague dread

Helps you stop feeling ashamed and start feeling in control

When you know “If I do X each month, I’ll be out of this by Y,” every payment feels like progress instead of punishment.

How It Works:

Step 1: Full Debt Snapshot

Your Coordinator gathers your info (balances, due dates, interest rates) and organizes it into one clean view.

Step 2: Pick a Payoff Method

Together, you decide on a strategy that fits your personality and budget — for example, “smallest balance first for quick wins” or “highest interest first to save the most money.”

Step 3: Build Your Monthly Plan

We help you decide what to pay on each account every month and how much you can realistically put toward extra payments.

Step 4: Protect Your Life Around It

We make sure your payoff plan still allows for rent, food, gas, and a basic quality of life. No starvation budgets.

Step 5: Ongoing Adjustments

As things change (job, income, emergencies), your Coordinator helps you update the plan instead of abandoning it.

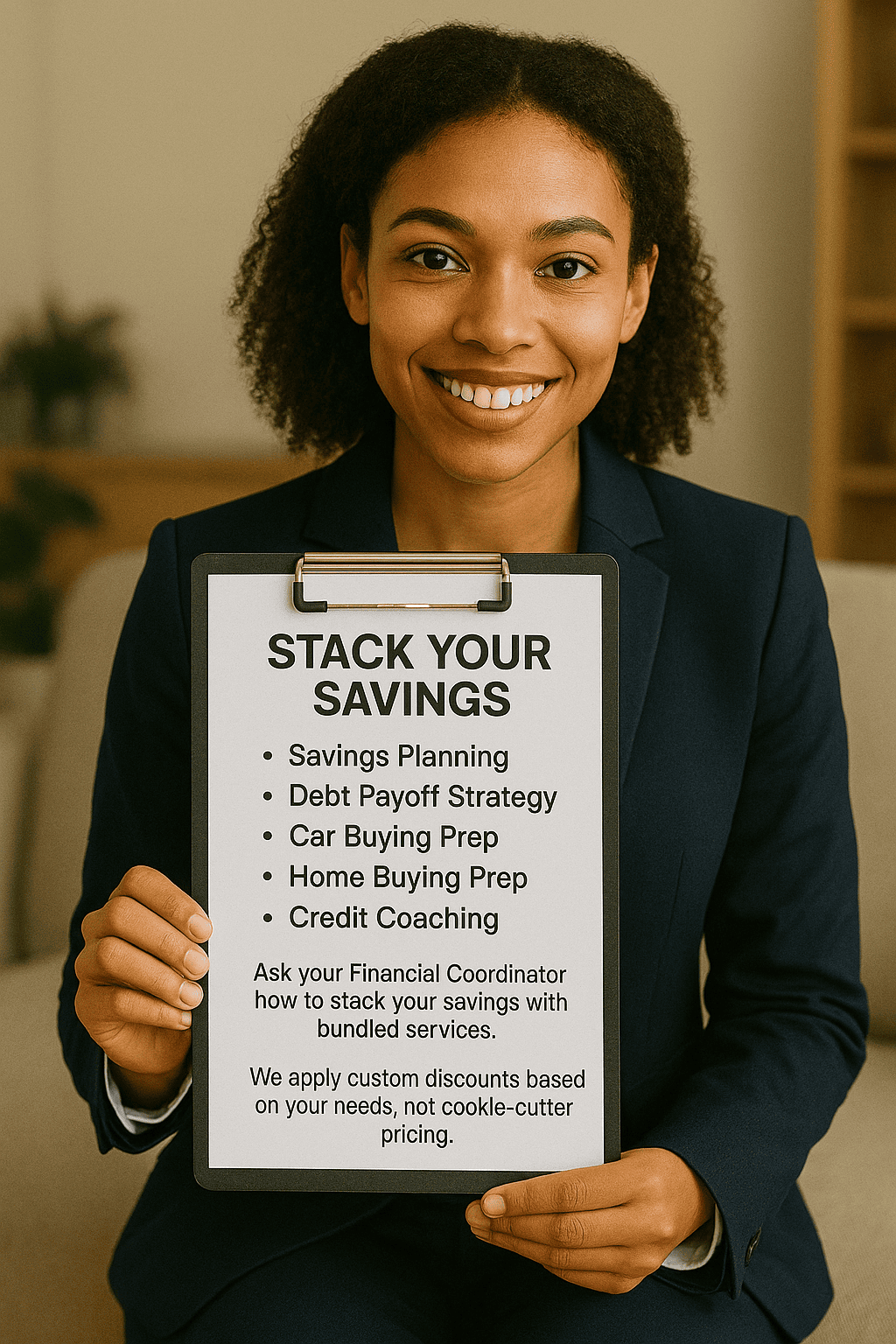

Bundling And Discounts:

The Debt Payoff Strategy service is one of our most powerful offerings, but it works even better when combined with:

- Savings Planning

- Bill Reduction Service

- Car Buying Prep

- Home Buying Prep

- Credit Coaching