Insurance Comparison and Review

Why It Matters:

Without a guide, most people:

Keep auto or renters policies for years without checking prices

Don’t know what their deductibles or limits really mean

Pay for extras they don’t need — or skip coverage that matters

That can cost you $50–$100/month or more… and still leave you exposed when something goes wrong.

Our goal is simple: keep you protected, but not overpaying.

How It Works:

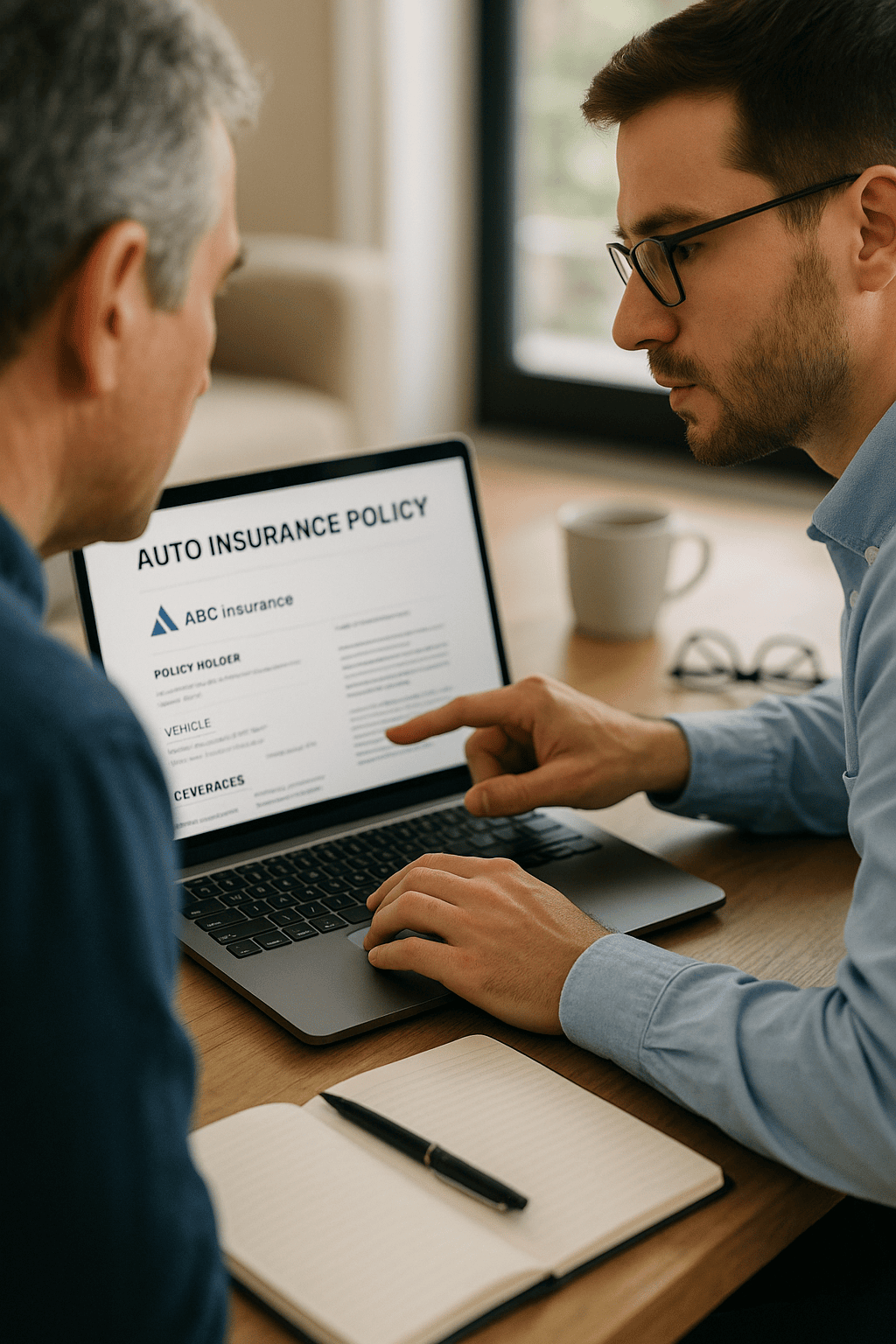

Policy review:

A plain-language walk-through of your current coverage, section by section, so you actually understand what each part does.Coverage vs. cost check:

We help you see where you might be paying more or less relative to your car, home, income, and comfort level — then you decide whether anything should change.Comparison prep:

We help you get ready to shop by making a list of the types of quotes you want to request and the questions you want to ask a licensed agent or company. We don’t tell you which carrier or exact policy to choose.Conversation practice:

You can talk through how different options feel with your Coordinator so you’re clearer and calmer before you speak with salespeople. We don’t recommend specific companies, products, or coverage levels.Annual check-in:

A yearly educational review of your policies to spot big price jumps or life changes that might mean it’s time to revisit things with a licensed professional.

We don’t sell insurance, we’re not an insurance agency, and we don’t earn commissions. We provide education and organizing help so you can have more confident conversations with licensed insurance professionals.

Bundling And Discounts:

The Insurance Comparison and Review service is one of our most powerful offerings, but it works even better when combined with:

- Savings Planning

- Bill Reduction Service

- Debt Reduction Planning

- Car Buying Prep

- Credit Coaching