Student Loan/FAFSA Support

Why It Matters:

On their own, people:

Avoid logging in to see balances

End up on random repayment plans

Miss recertification deadlines and get hit with higher payments

Carry a ton of anxiety and shame around their loans

Student Loan Support:

Gives you a clear picture of what you owe and to whom

Helps you understand your options without sales pressure

Ties your loan decisions to your real-world cash flow

You’re paying for translation, organization, and planning, not government magic.

How It Works:

1. Loan Inventory – Your Coordinator helps you gather balances, servicers, and basics into one snapshot.

2. Plain-English Explanation – You get a simple breakdown of what you have and what typical options exist.

3. Option Walkthrough – You talk through repayment paths you might want to explore and how they’d change your monthly picture.

4. Budget Fit – You build a monthly plan where your loans have a slot, not just chaos.

5. Next-Step Checklist – You leave with a list of what to do on the official sites (forms, logins, deadlines).

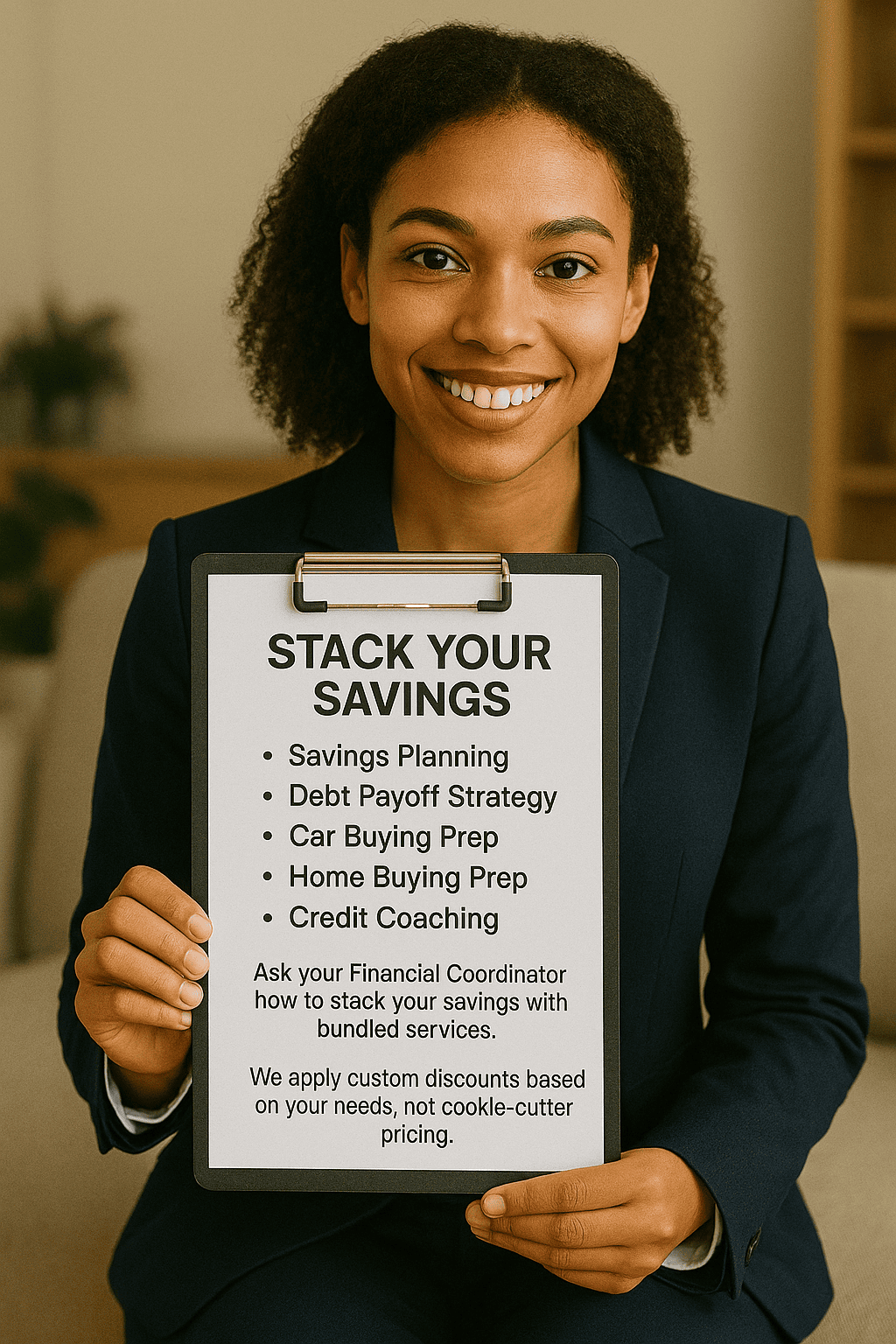

Bundling And Discounts:

The Student Loan/FAFSA Prep service is one of our most powerful offerings, but it works even better when combined with:

- Savings Planning

- Bill Reduction Service

- Debt Reduction Planning

- Car Buying Prep

- Credit Coaching