Savings Planning

Start saving on purpose — not by accident.

Most people want to save more, but life keeps getting in the way. We help you create a realistic savings plan built around your actual income, bills, goals, and timeline. This isn’t a guilt trip — it’s a game plan. Whether you’re trying to build an emergency fund, take a vacation, or just stop living paycheck to paycheck, we’ll walk you through it step by step.

Why It Matters:

Because most Americans don’t have enough savings to survive a $400 emergency.

Savings isn’t just about discipline — it’s about systems. With our help, you’ll stop guessing and start stacking. Studies show people are 10x more likely to reach a savings goal when they use structured reminders, real-life coaching, and visible progress. That’s exactly what we offer.

How It Works:

Once your Coordinator understands your budget and spending habits, they’ll help you:

Identify your savings goals and timeline

Choose the right amount and frequency

Automate it or build a manual plan that fits your lifestyle

Track your success using simple monthly reviews

We don’t control your money — we coach you to take control of it.

Bundling And Discounts:

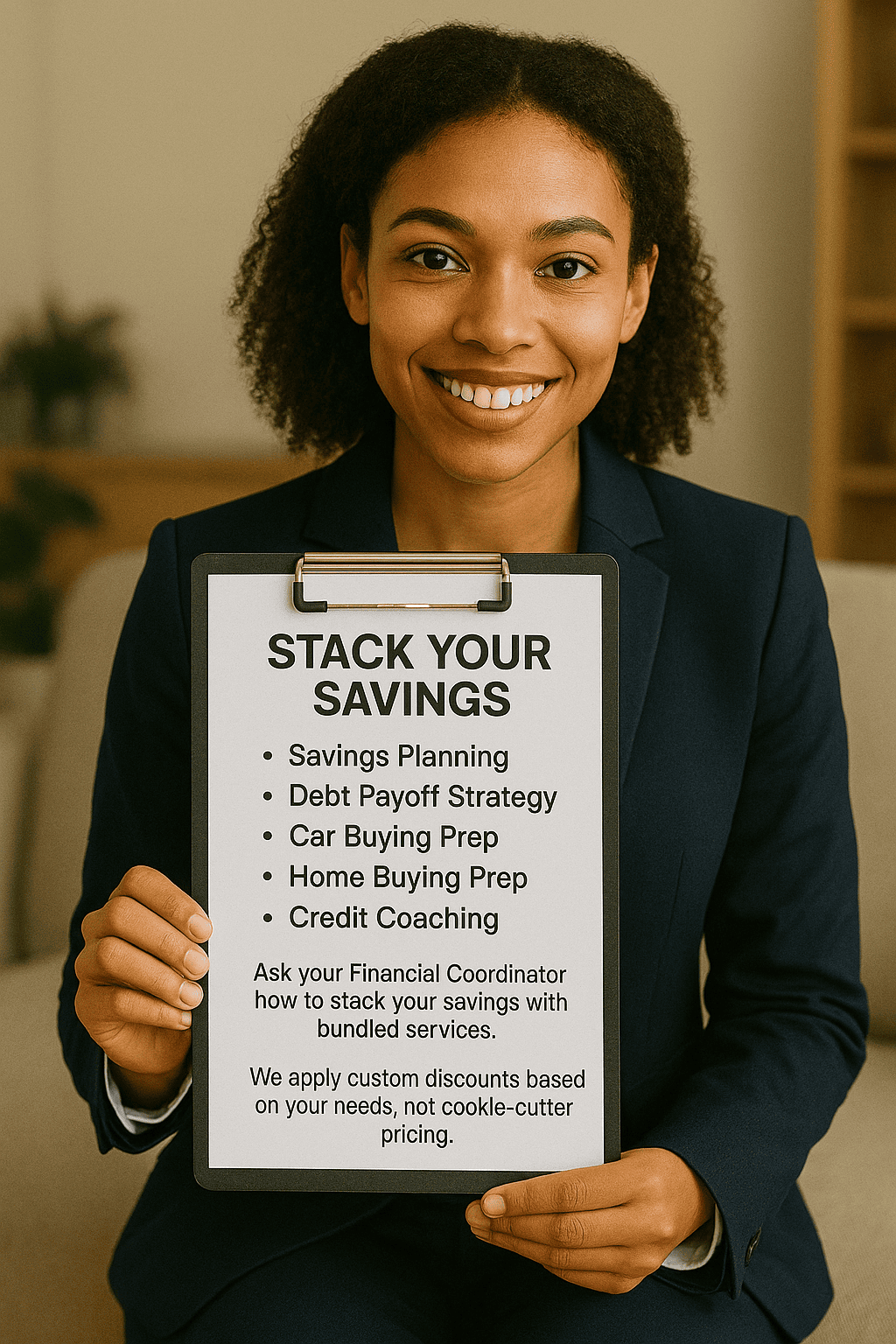

The Savings Planning service is one of our most powerful offerings, but it works even better when combined with:

- Savings Planning

- Debt Payoff Strategy

- Car Buying Prep

- Home Buying Prep

- Credit Coaching