Home Buying Prep Service

Turn "Someday" into a real plan to buy a home.

Why It Matters:

Most people:

Don’t think about this until they already love a house

Get blindsided by credit/debt issues during pre-approval

Underestimate how much they need for closing and emergencies

Home Buying Prep:

Moves the “bad news” or “good news” forward in time

Gives you a list of specific steps instead of vague advice

Helps you show up to a lender prepared, not desperate

You’re paying for clarity and readiness, not a loan.

How It Works:

1. Financial Snapshot – Your Coordinator reviews your income, debts, savings, and monthly spending.

2. Lender-Style View – You walk through how a typical lender might see your situation (in plain English).

3. Readiness Roadmap – You leave with a simple, written plan: what to pay down, what to save, and behaviors to keep clean.

4. Do’s & Don’ts – You get a list of “avoid this while prepping” items (new loans, big balances, etc.).

5. Optional Progress Check-Ins – Follow-up review sessions are separate paid coaching add-ons when you want them.

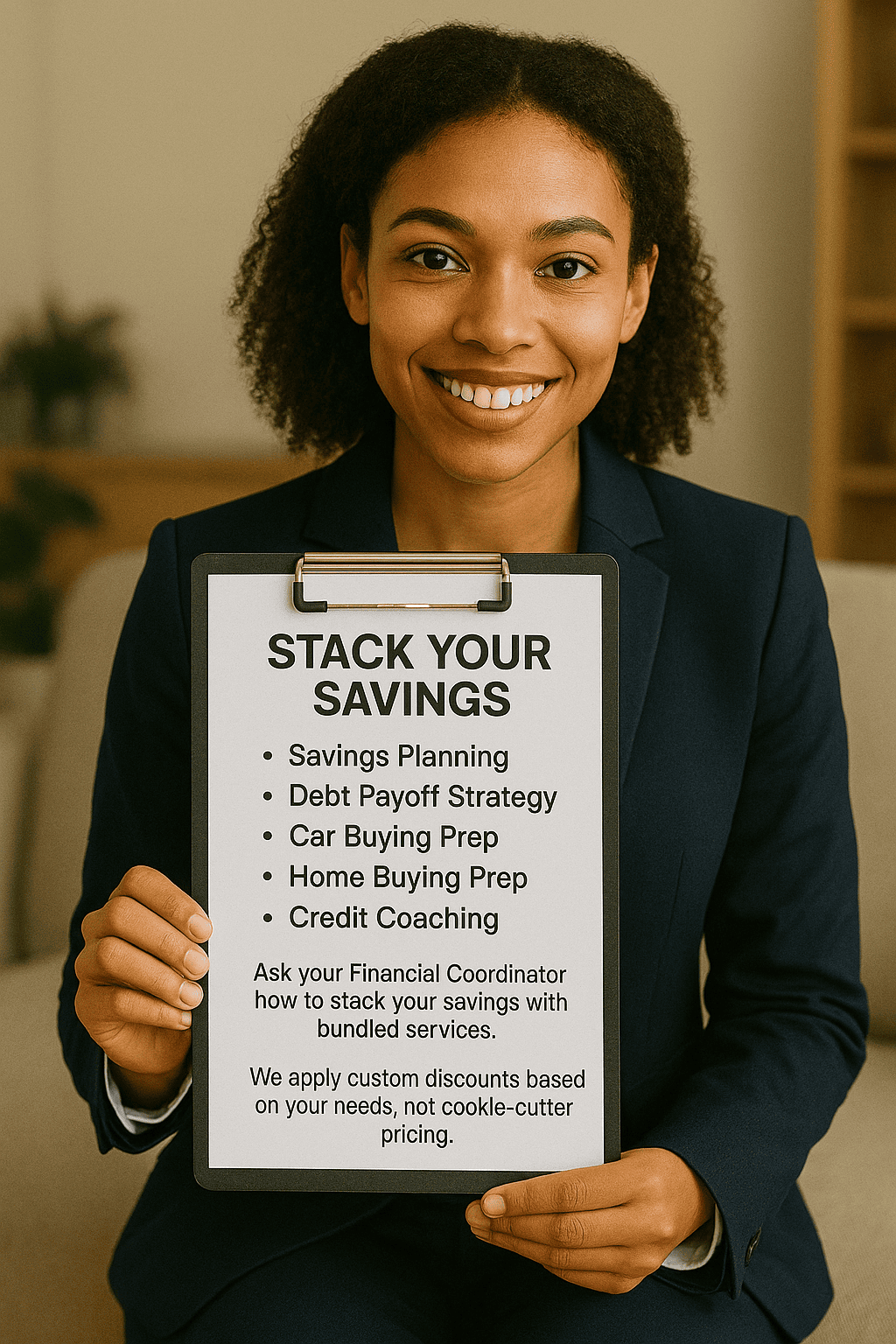

Bundling And Discounts:

The Home Buying Prep service is one of our most powerful offerings, but it works even better when combined with:

- Savings Planning

- Bill Reduction Service

- Debt Reduction Planning

- Car Buying Prep

- Credit Coaching